Airbnb: The Digital Evolution of the Hotel Industry

How Airbnb’s digital business model has contributed to their success

The new age of Hotels

After years of very little change, the hotel industry has experienced the emergence of digital platforms such as Airbnb who operate with no fixed assets. Airbnb is an accommodation rental platform that launched in 2007 when Brian Chesky and Joe Gebbia started an Airbed & Breakfast on their living room floor in San Francisco (Statista, 2018). Airbnb’s rapid growth has come from their ability to differentiate themselves from traditional hotel chains by fundamentally changing society’s approach to accommodation and leveraging the power of technology to create vast networks. Consequently, Airbnb is now considered one of the largest hotel firms as 2 million people stay in Airbnb’s every night, across 100,000 cities worldwide (Airbnb, 2020). But what is it about Airbnb’s digital business model that has made them so successful?

The following YouTube video provides a comprehensive overview of Airbnb and how the concept developed to what we know today.

The true success of Airbnb’s concept was seen in 2013 as sales started to threaten those of longstanding hotel chains such as Marriott, proving that Airbnb had successfully flipped the traditional hotel business model on its head. Since then, Airbnb’s sales have grown exponentially, as shown in figure 1 (Hancock, 2019a). Today, Airbnb has 6 million listings, spanning across 191 countries, meaning that they have more listings than the top 5 hotel brands combined (BMI, 2020; Airbnb, 2020). However, much of the effort of traditional hotels to combat Airbnb’s online competition has focused on simply improving loyalty schemes (Hancock, 2019a). In fact, it wasn’t until April 2019 that Airbnb saw any significant retaliation from traditional hotel groups as Marriott launched its own home rental service and Accor acquired Onefinestay (Hancock, 2019b). Consequently, both stepped into Airbnb’s market.

The Business Model

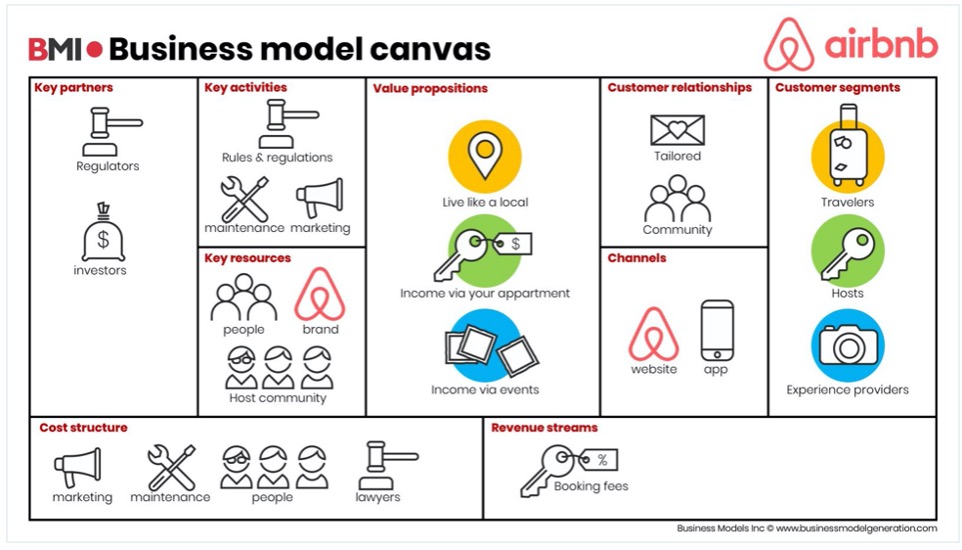

Airbnb’s business model of a peer-to-peer two-sided marketplace on a digital platform connects travellers with hosts and experience providers (BMI, 2020). This business model has caused significant shifts in the hospitality market by enabling Airbnb to scale hospitality through connecting mass markets in a unique way that considerably outcompetes that of traditional hotels (BMI, 2020). This digital business model has also led to Airbnb’s considerable success through the fact that they do not own any fixed assets (Figure 2), allowing them to operate with significantly lower costs and higher profit margins than normal hotel chains. Figure 2 illustrates Airbnb’s business model canvas and highlights how they add value for consumers to outcompete their market.

SMAC

Part of Airbnb’s success can be attributed to their use of ‘Social, Mobile, Analytics and Cloud’ (SMAC). Whereby they have interconnected social media accounts such as Facebook to track and store cookies from users’ browser history, allowing for a more personalised service. In addition to this, Airbnb has successfully developed an app for smartphones to increase the number of people able to access their platform as the number of smartphone users today stands at roughly 3.5 billion and counting (Statista, 2019). By capitalising on this increased use of mobile technology and engaging effectively in social media, Airbnb is able to tap into new ways of engaging with their consumers as well as acquiring them, which has helped put them ahead of traditional hotel groups. Beyond this, Airbnb also allows users to share stays and experiences via a plethora of social media platforms, which allows content to be shared in a single touch whilst aiding their success (Olenski, 2016).

The Sharing Economy

A significant factor in Airbnb’s success has been their ability to tap into the sharing economy. For those who are unfamiliar with the sharing economy, the video below shows an overview of this concept and also draws upon many organisations who have successfully capitalised from its mounting importance.

Whilst the sharing economy is not a new concept, Airbnb’s digital business model, which matches consumers to hosts with surplus rooms or entire houses, has made this transaction possible at an extraordinary scale. Hosts who own assets benefit from being able to fill their spare capacity, whilst guests have somewhere more interesting to stay and experience a place as a local would, and in return, Airbnb charges a fee to both parties (Moore, 2020). By modelling their business around the sharing economy, Airbnb has also benefited from the rising concerns for sustainability over the past decade as consumers see this as a more sustainable alternative to hotels (Heinrichs, 2013).

Part of the success Airbnb has experienced from this aspect of their business model is also due to their peer-to-peer reviews, in which both hosts and guests can review one another to ultimately build trust among the community of users. Not only this, but Airbnb also carries out comprehensive background checks for both hosts and guests among other safety precautions (Airbnb, 2020).

Airbnb has truly embraced the digital era and taken the hotel industry in a unique direction. But will they remain successful as competitors start to innovate and encroach on their market?

REFERENCE LIST

Airbnb. (2020). Trust & Safety. Retrieved February 2020, from Airbnb: https://www.airbnb.co.uk/trust

BMI. (2020). How Airbnb’s Exponential Business Model Works. Retrieved February 2020, from Business Models Inc: https://www.businessmodelsinc.com/exponential-business-model/airbnb/

Hancock, A. (2019b, June 4). Airbnb seeks to lure more hotels with new fee structure. Retrieved February 2020, from Financial times: https://www.ft.com/content/4df4293c-86dc-11e9-a028-86cea8523dc2

Hancock, A. (2019a, April 29). Marriott takes aim at Airbnb with home rental service. Retrieved February 2020, from Financial Times: https://www.ft.com/content/beb71d58-41ce-11e9-b896-fe36ec32aece

Heinrichs, H. (2013, December 17). Sharing economy: a potential new pathway to sustainability. GAIA-Ecological Perspectives for Science and Society, 22(4), 228-231.

Moore, E. (2020, February 25). Airbnb: finally, a tech listing that may not flop. Retrieved February 2020, from Financial Times: https://www.ft.com/content/d84fa418-56f6-11ea-abe5-8e03987b7b20

Olenski, S. (2016, May 26). Why Marketers Need A SMAC. Retrieved February 2020, from Forbes: https://www.forbes.com/sites/steveolenski/2016/05/26/why-marketers-need-a-smac/

Statista. (2018, March 1). Airbnb – Statistics & Facts. Retrieved February 2020, from Statista: https://www.statista.com/topics/2273/airbnb/#dossierSummary__chapter1

Statista. (2019, November 11). Number of smartphone users worldwide 2016-2020. Retrieved February 2020, from Statista: https://www.statista.com/statistics/330695/number-of-smartphone-users-worldwide/

Hi Kirstyn. This was a very informative article on Airbnb’s success. I do agree with you, but I also believe that AirBnB can be overpriced. Airbnb charges both the seller and buyer – the host has a 3% service fee which covers payment processing, while the buyer can expect a 6-12% service fee upon booking! Would this not mean misleading listing prices, since the price will increase upon booking? I do appreciate their privacy protection, however, since it allows both parties to stay safe during the renting process. I believe Airbnb is well on its way to replacing the traditional hotel booking services in the future!

LikeLike

Hi Kirstyn.

This is a very well researched article on Airbnb which provides a comprehensive overview of the company’s digital business model and how important this has been to its success. On this latter point, Airbnb has been extraordinarily disruptive to the traditional hotel industry, as your graph demonstrates.

However, I wondered if a comparison with other online travel agencies (OTAs) such as Expedia and Booking Holdings could have illuminated your dissection of Airbnb further. Both Expedia and Booking have sought to suppress the rise of Airbnb by offering a similar short-term rental service through their respective websites. Moreover, like Airbnb, they both operate an asset-light business model which should also minimise their cost base. I would argue these present a greater threat to Airbnb than any retaliation from the traditional hotel industry which is encumbered by physical assets and is likely to attract a different type of customer.

References

Skift Research. (2019). The Short-term Rental Ecosystem and Vendor Deep Dive 2019. Retrieved from https://cdn2.hubspot.net/hubfs/449646/Reports/skift%20short-term%20rental%20EXCERPT.pdf?

LikeLike